TRG | The Bottom Line – 2/9

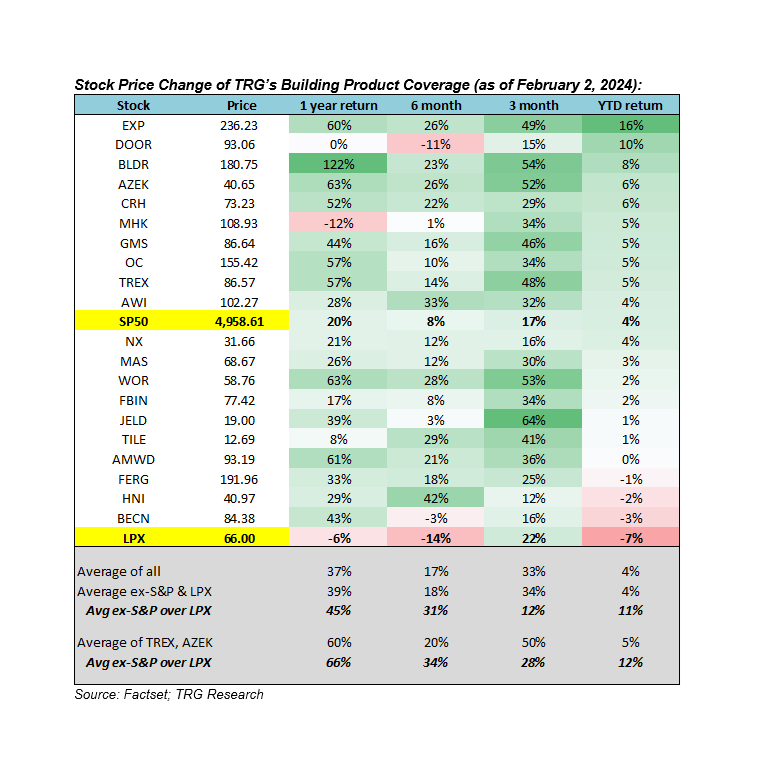

On January 31st, TRG initiated coverage of Louisiana Pacific (LPX, $70.02) and spent most of the report highlighting its near insurmountable moat in Siding, and the Siding business should continue to show rapid sales and more rapid EBITDA growth. In a note this week we highlighted how LPX is a loaded laggard, as its stock price has underperformed building product peers in TRG’s coverage on 3, 6, and 12- month basis. We believe this is unjustified and makes for a compelling entry point as there are many catalysts ahead: 1) 2023 had a unique combination of headwinds that are all resolved and create easier comps for this year, 2) LPX has historically outperformed SF starts by 8-10% and we favor companies with starts exposure over R&R exposure coming into 2024, and 3) LPX is holding an investor day at KBIS/IBS in which they could potentially update their long-term Siding margin guidance above the current 25% level. We expect the Siding segment will surpass that level in 2025.