TRG | The Bottom Line – 12/12

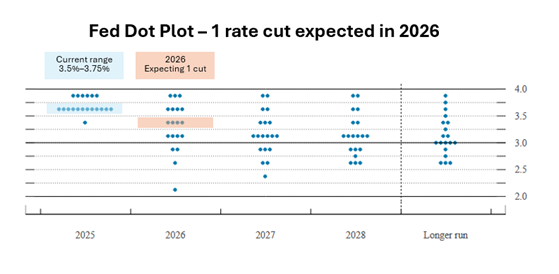

The Fed this week cut rates 25 bps to 3.5-3.75% and currently expects only one rate cut in 2026. It is possible there will be more than one when Powell is replaced mid-year, but current consensus is for one rate cut when looking at the Fed dot plot. The implications align with much of what we are hearing from our contacts both public and private on their outlooks going forward. Unless you are a data center builder, the common outlook theme is “flattish.” Resi doesn’t look to have much help from rate cuts at the moment, so a flattish outlook is the best conclusion that contacts are arriving at as we head into year end. Late this week Quanex (NX) reported results, citing “We enter fiscal 2026 with a cautious outlook … Our current view is that fiscal 2026 could be flat.” Earlier this month a private flooring manufacturer reported that their 2026 outlook for both new and R&R to be flat to modestly down. The story is somewhat the same on the overall non-res front with good trends in heavy non-res offsetting weaker trends in light/other non-res pockets. If the macro outlook is uncertain and flattish, then 2026 will be a year for companies to showcase their company-specific growth drivers. There can be winners and losers in a flat market, and TRG continues to highlight the themes that can drive value (i.e. scale matters) and the companies that are better positioned.